在dustrial 3D printer manufacturerEssentium的拟议与特殊用途收购公司(SPAC)合并大西洋沿海收购has collapsed, leaving its plans to go public hanging in the balance.

最初于2021年12月同意,Essentium的SPAC合并定于2022年第1季度末完成,此举本来可以看到它与大西洋沿海地区联手形成了一家公开上市的9.74亿美元公司。但是,该协议现已通过,导致Essentium的首席执行官Blake Teipel声称宏观经济因素使大西洋收购投资者脱离了交易。

“We appreciate the Atlantic Coastal team’s support and guidance throughout this process, and we are disappointed that market conditions prevented the parties from consummating this agreement,” explained Teipel. “We will continue to leverage the strength of our additive manufacturing technology and product system validated by theUS Department of Defenseto continue to advance additive manufacturing globally.”

尽管3D印刷行业确实采访了Teipel一对一,但他无法直接详细说明Essentium Spac合并背后的原因。结果,已经向公司书面向公司提出了进一步的详细要求,并在适当的时候将获得的任何其他信息都设置为本文。

Essentium的SPAC merger collapse

什么时候announced late last year,预计Essentium的SPAC合并将看到其筹集3.46亿美元的资金,这是基于其股票的初步估值,即每股10.00美元。当时,该公司根据估计将在2023年产生2.12亿美元的收入,并将其估值称为“有吸引力”,因为该公司将为4.6倍,这一数额为4.6倍。

此举不仅支持了4000万美元全额承诺的普通股管,价值超过4000万美元,由巴斯夫,,,,Atalaya,,,,and阿apeiron,但它还获得了两家公司董事会的一致认可。

然而,尽管如此,这笔交易已经软塌,智慧h Atlantic Coastal announcing that it will no longer be supporting Essentium’s proposed IPO. Under the terms of the termination, if it were to fail to acquire a target company in the future, or Essentium was to gain financing via another means, Atlantic Coastal would be granted the right to receive payments, though this will only happen in ‘certain circumstances.’

双方还同意,如果在2023年3月8日之前不出售Essentium,将允许大西洋沿海地区收购等于该公司5%的股份,这笔交易将其价值为5亿美元。

泰佩尔在谈到3D印刷行业时说,他既不能确认也不能否认该公司在此日期之前正在寻求完成替代IPO,但他确实表示,该交易的解散是“关键能力不受影响”。

为什么这笔交易失败了?

尽管双方都公开表示合并是通过“相互协议”报废的,但实际上,这是因为大西洋沿海地区为这一举动提供了支持。类似的命运困扰明亮的机器16亿美元的SPAC合并in late 2021, which fell by the wayside with timing being cited as an issue, but both deals’ termination does also reflect a growing hesitancy towards such IPOs.

在Shapeways与伽利略的合并,,,,for instance, it failed to attract the investor interest it had anticipated, raising1.03亿美元的总收入from the deal, far less than the $195 million it had hoped for. Likewise,velo3dgenerated $274 million worth of funding via itsmerger with JAWS Spitfire Acquisition,它首先以这一举动为目标的5亿美元以上。

It could be said that these relative failures to attract investor interest come down to the “market conditions” cited by Teipel for the collapse of his firm’s deal, but some analysts have also criticized the revenue projections and valuations attached to firms in the run-up to proposed SPAC mergers, withStanford Law School商业教授迈克尔·克劳斯纳(Michael Klausner)将他们标记为“畸变”。

克劳斯纳解释说:“市场最终了解到,对于投资者而言,SPAC是一件不良的交易。”“我认为这不是由于通货膨胀或任何形式的周期。在过去的十年中,SPAC平均每年都为投资者亏损。另一方面,对于目标而言,跨度[合并]可能是很多。这是因为SPAC的股东倾向于承担[交易]的成本。”

鉴于SPAC合并需要比传统IPO的披露较少的披露,因此在大西洋沿海地区发现某些导致其重新考虑其位置的东西之后,Essentium的交易也可能崩溃。2019年,贾比尔指控Essentium员工在IP盗窃案中,过去对其技术存在疑问,但是Teipel坚持认为这些技术已经被搁置了。

Teipel补充说:“因此,诉讼仍然得到解决……而与贾比尔有关。”“我要说的是,这支团队拥有一个非常强大且强大的知识产权组合,拥有150多种专利,在美国,国际上,在国际上,在材料,机器,流程甚至国际上都处于起诉的各个阶段。某些行业。”

Essentiumconfirms staff layoff

While Atlantic Coastal has already announced that it “will seek an alternative business combination,” Essentium’s IPO has been somewhat left in the lurch by the failure of its SPAC merger. The deal’s collapse has no doubt affected the firm’s run rate, as it has missed out on a significant funding opportunity, and some of its employees recently took to Linkedin to announce a其员工的“广泛裁员”。

Speaking to 3D Printing Industry, Teipel confirmed that this was indeed the case, with around 40% of its workforce being laid off towards the end of January. What’s more, even though Essentium’s CEO argued that sometimes “promising, high-growth companies face headwinds,” and that the move wouldn’t affect the firm’s “ability to operate,” he couldn’t say for sure that further layoffs won’t be needed.

“我们不得不做出一个艰难的调整我们的决定team size at the end of January,” added Teipel. “We have done everything we can to make sure that it’s kind of ‘one and done,’ but you never know what the future holds. The goal here though, is to make sure that we have an absolutely amazing group, so that we can move forwards and support our clients.”

Are SPAC mergers falling out of fashion?

During the last 18 months alone, the number of 3D printing firms choosing to go public via SPAC mergers has shot up, with more than $16 billion worth of these deals being agreed upon. Becoming publicly listed in this way is known to provide benefits compared to doing so via normal IPOs, particularly when it comes to the pace at which they can be conducted, as they’re often finalized within a matter of months.

这个简化的过程还意味着,SPAC合并要求公司在法律费用和财务咨询上花费更少的花费,使其更便宜地进行,而他们经常以管道的形式提供利润丰厚的资金机会,这是一种类似的快速投资形式到目前为止,私人投资者保证将超过29亿美元倒入与3D印刷相关的企业中。

但是,在我们的SPAC分析last year, experts such as John Howe of the密苏里大学预测,对这些交易的兴趣已成为锁定期间的“爱好或分心”,并且随着事情的开放,“将会少一些”。Essentium's Deal的崩溃表明Howe的强制性可能正在实现吗?

要了解最新的3D印刷新闻,请不要忘记订阅3D打印行业通讯or follow us on推特or liking our page onFacebook。

为了深入研究添加剂制造,您现在可以订阅我们的YouTube频道,包括讨论,汇报和3D打印进程的镜头。

您是否正在寻找添加剂制造业的工作?访问3D打印作业在行业中选择一系列角色。

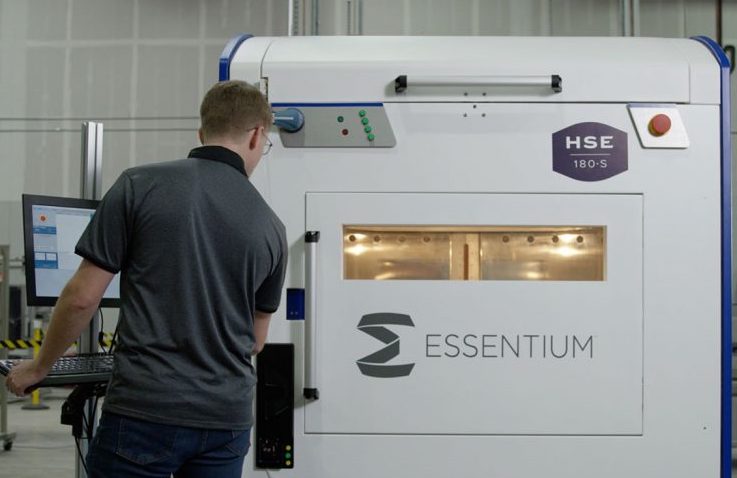

特色图像显示了使用Essentium的HSE 180-S 3D打印机的工程师。通过Essentium的照片。