Industrial 3D printer manufacturerEssentium已经公布了通过与特殊目的收购公司(SPAC)合并公开公开的计划Atlantic Coastal Acquisition。

Set to be completed by the end of Q1 2022, the deal will see the firms combine into a joint venture worth an estimated $974 million, that’ll be listed on Nasdaq under the ticker ‘ADTV.’ It’s anticipated that the transaction will raise the resulting enterprise $346 million, but the companies have already poured cold water onto spending speculation, by saying “proceeds are expected to primarily fund organic growth.”

“We believe that following this transaction, Essentium will be extremely well-positioned for rapid growth as it further expands its ecosystem offerings, capitalizes on its line-of-sight sales pipeline, and executes on its M&A strategy as it continues to advance AM as a public company,” Tony Eisenberg, CSO of Atlantic Coastal Acquisition said on the deal.

High Speed Extrusion technology

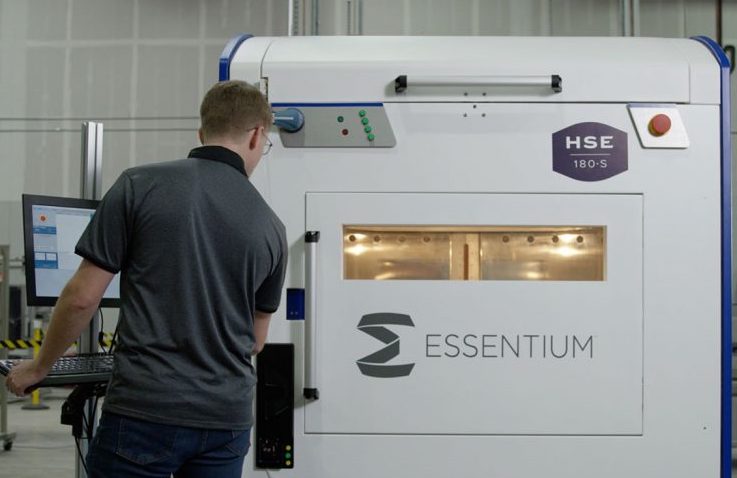

Essentium may have been around since 2013, but it didn’t launch its flagship High Speed Extrusion (HSE) technology until 2018. Designed to address the speed and strength drawbacks of traditional FFF systems, the company claims that its HSE printers are up to 15 times faster, while their in-built cameras are said to provide quicker datastreams as well, allowing users to monitor builds with high-precision.

在过去的三年中,Essentium稳步扩展了平台,首先与巴斯夫andMaterialiseto introduce anopen high-speed 3D printing model, then seeking to better support this with a新的窥视和尼龙系列它与LEHVOSS, as well as a fresh batch ofhigh-performance filamentswith aerospace, electronics and defense potential.

On the machine front, the firm has also expanded on its offering recently, by adding theHSE 240Tto its existingHSE 180 SeriesandHSE 280I HT投资组合ATFormnext2021.销售作为一个“紧凑的powerhouse,” the new system is designed to be small enough to fit into an SME’s factory, while still efficient enough to deliver cost and lead time benefits to those switching from traditional manufacturing.

Additionally, like many other 3D printing technologies, Essentium cites the potential of HSE to help manufacturers in-source their production as being one of its major benefits, and following its SPAC merger, the firm’s CEO Blake Teipel says that it’s now set to raise the funding necessary to truly scale the platform’s “distributed production capabilities.”

“Fundamental deficits in our existing global supply chain models are being exacerbated by escalating obstacles such as trade imbalances and the global pandemic,” said Teipel. “Today’s announcement represents a major milestone in our efforts to provide long-term, sustainable solutions for a new manufacturing paradigm that can meet these global challenges head-on.”

即将举行的9.74亿美元IPO

Atlantic Coastal’s proposed merger with Essentium sees it value the soon-to-be-formed firm at $10.00 per share, assuming there are no redemptions by its shareholders. Given that Essentium anticipates generating $212 million by 2023, the deal could be lucrative for its shareholders, as the combined company is expected to be worth 4.6 times that amount.

Once the transaction is complete, the shareholders of both firms will roll their equity into the resulting enterprise, with Essentium’s backers retaining 64% of the stock, and Atlantic Coastal’s set to inherit 36%. For stockholders of the latter seeking to use their redemption rights over the deal, the company andAtalaya-affiliate ACM ARRT VII C LLC have agreed to conduct a joint tender offer for these shares.

在受到限制的情况下,本协议将使Atalaya购买行使这种赎回权的股东招标的前1000万股股票,而大西洋沿海地区已承诺购买其余的股票。如果交易在未来两年内终止,大西洋沿海地区也同意以赎回价格购买Atalaya的股票,从而增加了交易的稳定性。

In terms of funding, the merger is expected to deliver up to $346 million in net proceeds to the combined company, assuming there are no redemptions or expenses related to the deal’s closure. Although Atlantic Coastal has a reported $346 million on its balance sheet, part of this capital will also be raised via a $40 million PIPE, backed by Atalaya, BASF,Apeiron, and investorChristian Angermayer。

Looking ahead, the merger may still be subject to the approval of shareholders, but the boards of both firms have unanimously approved the deal, and according to Atlantic Coastal CEO Shahraab Ahmad, the sustainability benefits of Essentium’s HSE technology should make it an ideal partner to achieve its eco-goals with moving forwards.

艾哈迈德补充说:“我们以以ESG为中心的重点开设了大西洋沿海地区,并具有与一家将改变国际贸易本质的公司合作的任务。”“我们相信Essentium正是那个合作伙伴。Blake和他的经验丰富的团队开发了深厚的技术护城河,可提供大量的经常性收入,支持毛利率扩张和极具吸引力的单位经济学。”

AM’s SPAC IPO trend resurfaces

Over the last 18 months, a3D打印公司的绳子选择通过SPAC合并而不是传统IPO公开,这在此过程中筹集了大量资本。在Essentium的大揭露之前,部分服务提供商Fast Radius在揭幕了通过A公开的计划之后,这是其中的最新9.95亿美元的SPAC合并2021年7月。

On the flipside, the likes ofXometryhave also decided to go public recently but chosen to do so via conventional IPOs rather than deals with SPACs. Despite not having SPAC-backing, the company was still able toraise a reported $302 million从交易中,比最初预期的要多了近5000万美元。

3D printer manufacturerFormlabs另一方面,说是避免诱惑to cash in on the industry’s SPAC IPO trend, after it raised $150 million in May 2021. The firm’s CEO Max Lobovsky reportedly said at the time that it was “large enough and mature enough” to go public, but that it would “take its time” and make sure it was ready to excel before making such a move.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the3D打印行业通讯or follow us on推特or liking our page on脸谱网。

为了深入研究添加剂制造,您现在可以订阅我们的Youtubechannel, featuring discussion, debriefs, and shots of 3D printing in-action.

您是否正在寻找添加剂制造业的工作?访问3D打印作业在行业中选择一系列角色。

图片显示了一个使用Essentium工程师的HSE 180-S 3D printer. Photo via Essentium.