Automated post-processing system manufacturerPostProcesshas published the findings of its2022印刷趋势调查.

后处理的第四次年度调查的结果反映了制造商对更好地应对劳动力短缺并实现其可持续性目标的方式的需求不断增长。在后处理方面,该公司还确定了二级流程的趋势,以及对生产规模技术的用户之间对当前产品的适用性以满足其扩展需求的适用性。

“I often hear post-processing referred to as the ‘dirty little secret’ in additive manufacturing, but it doesn’t need to be,” said Melissa Hanson, CMO of PostProcess. “We are excited to continue our mission of bringing this critical step in the overall 3D printing workflow to the forefront and spearhead the analysis of post-processing trends, which comes with much anticipation and is essential to growing the rapidly evolving additive industry.”

What is the Post-Printing Trends Survey?

在过去的四年中,后过程通过其年度行业调查向后处理系统的用户询问了他们的反馈。利用最终的数据,该公司养成了将市场细分报告汇总在一起的习惯,这些报告表明了3D打印零件如何最常完成,除了如何进行后处理成本和交货时间之类的指标继续变化。

Previous PostProcess surveys have already proven very insightful, uncovering the relationship between resin removal and surface finishing, as well as3D printing’s volume manufacturing trend. Building on these findings, this year’s survey has yielded an even deeper analysis, revealing other key trends, and the company believes it’ll “serve an integral resource” for mapping a rapidly evolving sector.

The basis for 2022’s report is also stronger than ever, with 34% of respondents having used 3D printing for a decade or more, twice as many as last year. In terms of demographic, 83% of contributors came from the US and Europe, while 9% are now operating in the APAC region (up from 0% just two years ago), and the top three participating sectors were medical, machinery and manufacturing.

Uncovering post-processing challenges

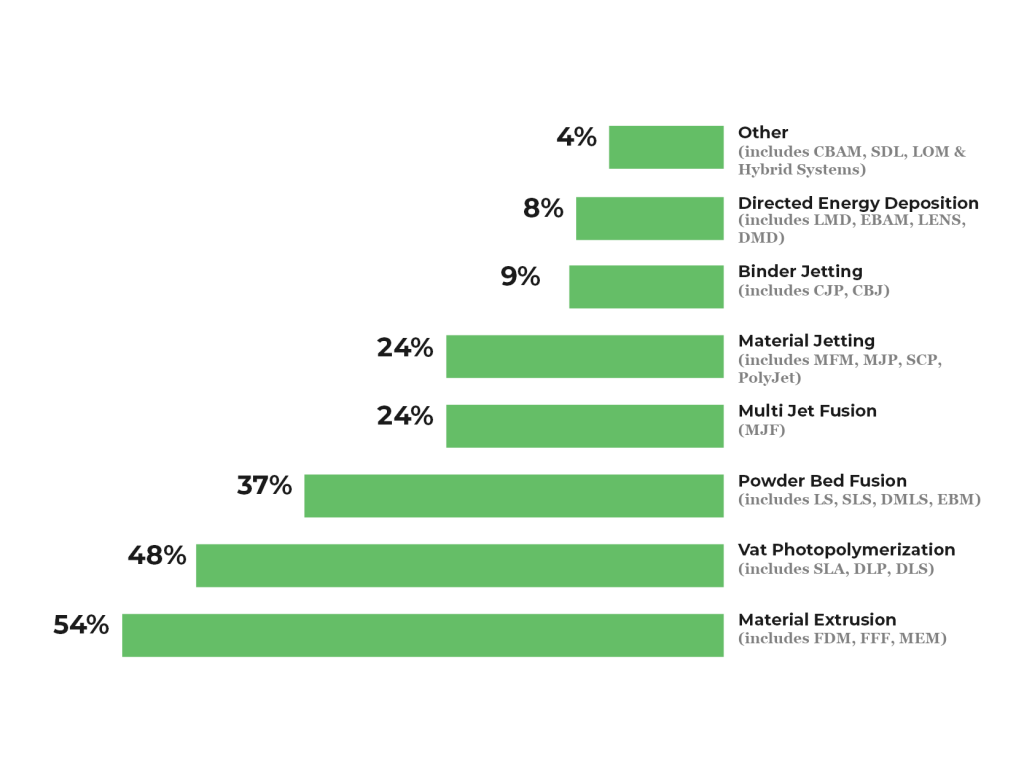

When it comes to the main 3D printing technologies adopted by users, PostProcess found no change against last year, with material extrusion proving the most popular. Interestingly, however, this year’s report identified a shift towards end-production applications in vat polymerization and powder bed fusion (PBF), the users of which made up 48% and 37% of respondents respectively.

On a recent webinar arranged to publicize the report’s findings, it was also revealed that the number of manufacturers using two or more print technologies has stabilized at around 50%, coming in this year at 57%. According to one of the session hosts, the firm’s VP of Strategic Partnerships Dean VonBank, this is happening due to users trying technologies, but “as they move to production, focusing on one or two.”

Elsewhere, PBF adopters said the challenges they face have shifted as well. Two years ago, PostProcess’ report found that such users were primarily concerned about labor costs, damaged parts and throughput. Now they’re not only dealing with staffing issues, but increasingly showing environmental and waste management concerns. VonBank added that PBF users are likely “trying to find the right labor” to implement production-scale workflows, and targeting those able to do so efficiently.

On the post-processing side of its survey, PostProcess found that the same three technologies remained the most-used: support removal (54%), resin removal (42%) and surface finishing (39%). While this has remained unchanged over all four iterations of the firm’s report, VonBank said the firm is now seeing “secondary processes cropping up” like vapor smoothing, dyeing and curing, as “people look for things that can get them an even better part than they’ve seen in the past.”

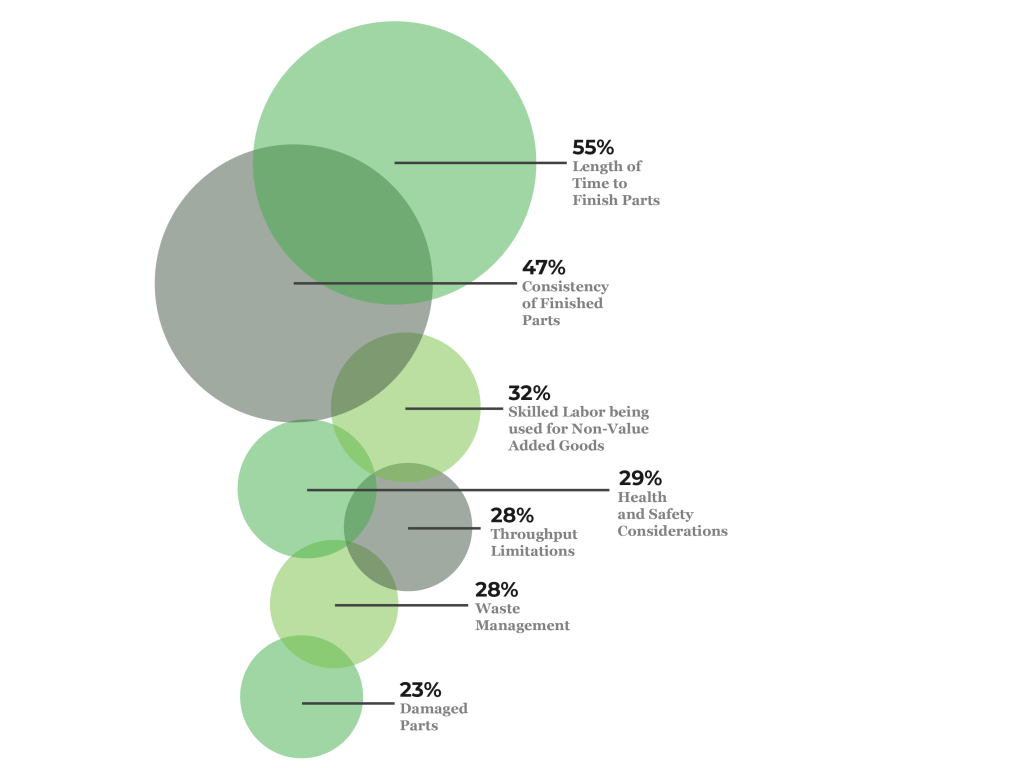

More broadly, the report has also highlighted some of the ongoing challenges facing the users of post-processing systems. For a third year in a row, the length of time required to finish parts was respondents’ number one gripe (55%), with consistency being deemed the second biggest issue (47%) faced by those treating 3D printed products.

Lastly, when asked if current post-processing methods contribute or inhibit their 3D printing goals, the majority of contributors said they remain acceptable or challenging today. Users of production-oriented technologies like PBF, material jetting, vat polymerization and Directed Energy Deposition (DED), also identified part finishing as an issue that could become more of a bottleneck in future, as they scale.

PostProcess Technologies encourages anyone who currently utilizes or is interested in additive manufacturing to sign up toreceive a full copy of the 2022 Post-Printing Trends Report here.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the3D Printing Industry newsletteror follow us onTwitteror liking our page onFacebook.

While you’re here, why not subscribe to ourYoutube渠道?包括讨论,汇报,视频短裤和网络研讨会重播.

Are you looking for a job in the additive manufacturing industry? Visit3D Printing Jobsfor a selection of roles in the industry.

特色图片显示了iPad访问后过程的年度调查的模型。通过后进程图像。